38+ Fha loan calculator with closing costs

The delinquency rate was 638 of all mortgage loans outstanding at the end of the first quarter of 2021. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

38 percent of buyers are more willing to check a staged house they saw.

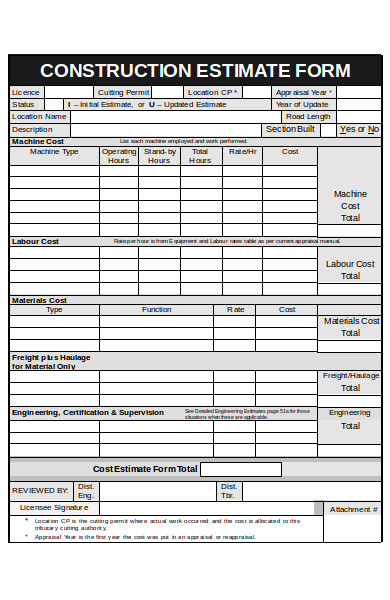

. Documentation expenses and closing costs including loan origination fees which are easily compared using the form. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Quoted conventional conforming 30yr fixed rate for a loan scenario with at least 20 down and no.

The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. Its a popular financing tool among first-time homebuyers who have yet to build larger savings. P Principal Amount initial loan balance i Interest Rate.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually. Todays national mortgage rate trends.

4 ways to keep your mortgage closing costs low June 22 2017 USDA eligibility and income limits. To the consumer in the form of higher closing costs. You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options.

Closing costs and other charges are all included in the APR estimation which is provided by the lender when shopping for a loan. The following calculator makes it easy to quickly estimate the closing costs associated with selling a home the associated net proceeds. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

Buying a home is still considered a key aspect of the American dream. Whether you are building your own house or getting a loan for home improvement the home construction loan calculator will calculate the monthly loan payments with an amortization table and chart that is exportable to an excel. On average the closing cost for a conventional loan falls between 3 percent to 6 percent of the homes value.

Affordable closing costs and easy credit qualification. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. There are certain requirements borrowers must meet to qualify for an FHA loan including.

SBA 7a loans fully amortize and typically paid up to 25 years. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. This calculator figures monthly FHA loan payments based on the principal amount borrowed the length of the loan and the annual interest rate.

FHA Loan limits vary nationwide for. The above calculations presume a 20 down payment on a 250000 home a closing cost of 3700 which is rolled into the loan. Seller Closing Cost Calculator.

9135 to get a free quote. All home equity calculators. On the other hand interest rate only describes what youll be paying in interest every month.

The lender then takes the property and recovers the amount of the loan and also keeps the interest and principal payments as well as loan origination fees. Home Construction Loan Calculator excel to calculate the monthly payments for your new construction project. Simply enter your sales price mortgage information closing date and well estimate your totals.

The home you consider must be appraised by an FHA-approved appraiser. Give our specialist a call today at 858 997. 2 to 5 percent of the mortgage amount which would equal 3000 to 7500 on a 150000 loan.

You must occupy the property within. As a first-time buyer you have access to state programs tax breaks and federally. FHA 30 Yr.

Advanced Estimated Closing Cost Calculator Conventional FHA VA More. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

Benefits of Being a First-Time Homebuyer. It also helps you understand the total cost of home ownership over the entire loan term by taking into account one-time expenses closing costs home furnishing etc and recurring costs such as property taxes homeowners insurance and HOA fees. M Monthly Payment.

For example if you buy a house worth 450000 the closing cost can be anywhere between 13500 to 27000. A Practical Example Highlighting Common Closing Costs. From traditional refinances VA loans new purchases jumbo loans streamlined FHA loans and reverse mortgages for cash flow we have a solution for you.

September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt. Here are some important points that you should be aware of. Home equity loan and HELOC guide.

The Math Behind Our Mortgage Calculator. An SBA 7a loan may guarantee up to 85 percent of the loan amount if the mortgage is 150000. You can only get a new FHA loan if the home you consider will be your primary residence which means that it cant be an investment property or second home.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. FHA Streamline closing costs are typically the same as other mortgages. Home equity line of credit HELOC calculator.

For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. This loan can be taken as fixed-rate mortgage a variable-rate mortgage or as a combination of the tow. If you need a higher loan amount the SBA can guarantee up to 75 percent.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. Mortgage loan basics Basic concepts and legal regulation. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility. This includes upfront costs such as underwriting fees broker fees and loan origination fees. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage.

Line of credit calculator.

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

A Href Https Www Mortgagecalculator Org Calculators Should I Refinance Php Img Src Https Www Mo Refinance Mortgage Refinancing Mortgage Home Refinance

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

Free 6 Service Estimate Forms In Pdf Ms Word

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Free 38 Sample Estimate Forms In Pdf Ms Word

Home Sellers Closing Costs Calculator Mls Mortgage Amortization Schedule Mortgage Estimator Mortgage Calculator

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Tim Mcbratney Cma Pacres Mortgage

G64421mmi034 Jpg

14 Best Crypto Lending Platforms Crypto Loan Sites In 2022

Tim Mcbratney Cma Pacres Mortgage

Home Buyers Closing Cost Calculator Mls Mortgage Closing Costs Mortgage Home Loans

G64421mmi009 Jpg

G64421mmi019 Jpg